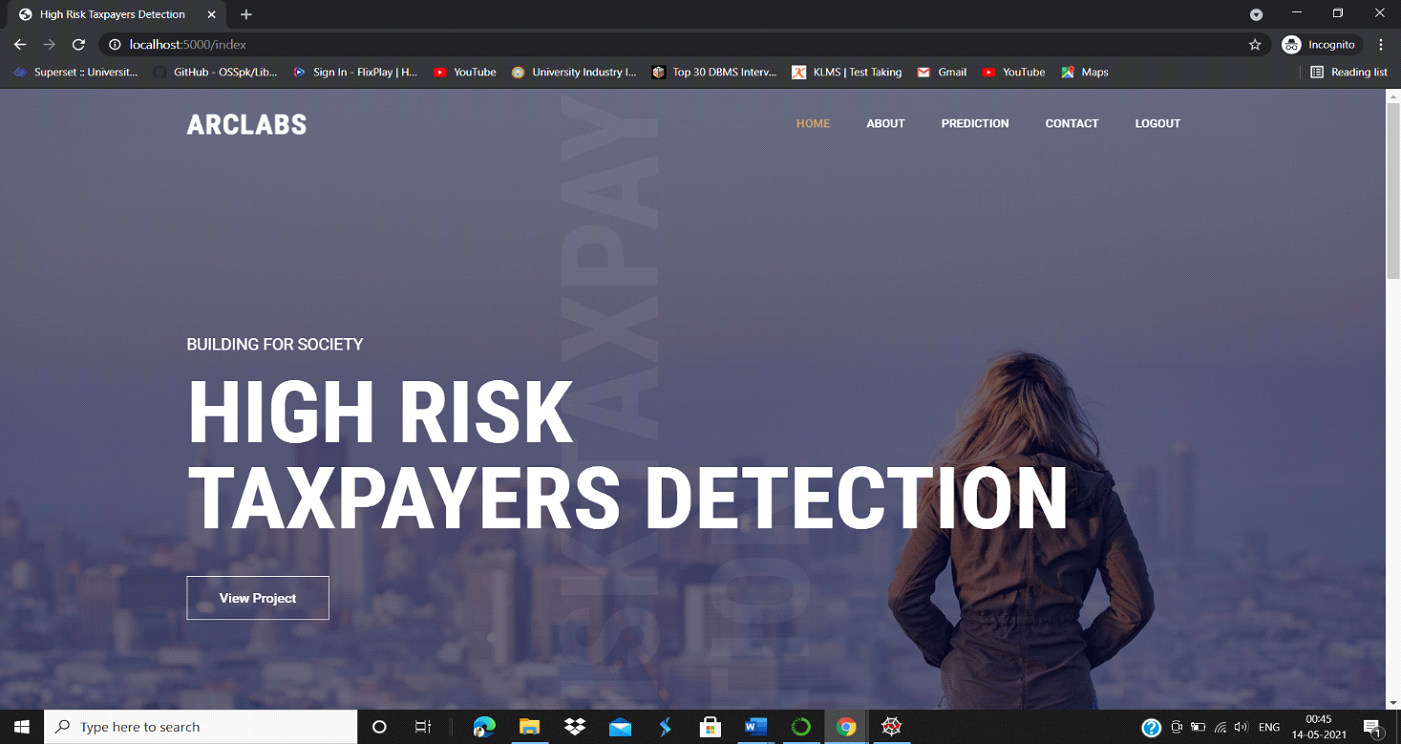

High-Risk Taxpayer Detection Using ML

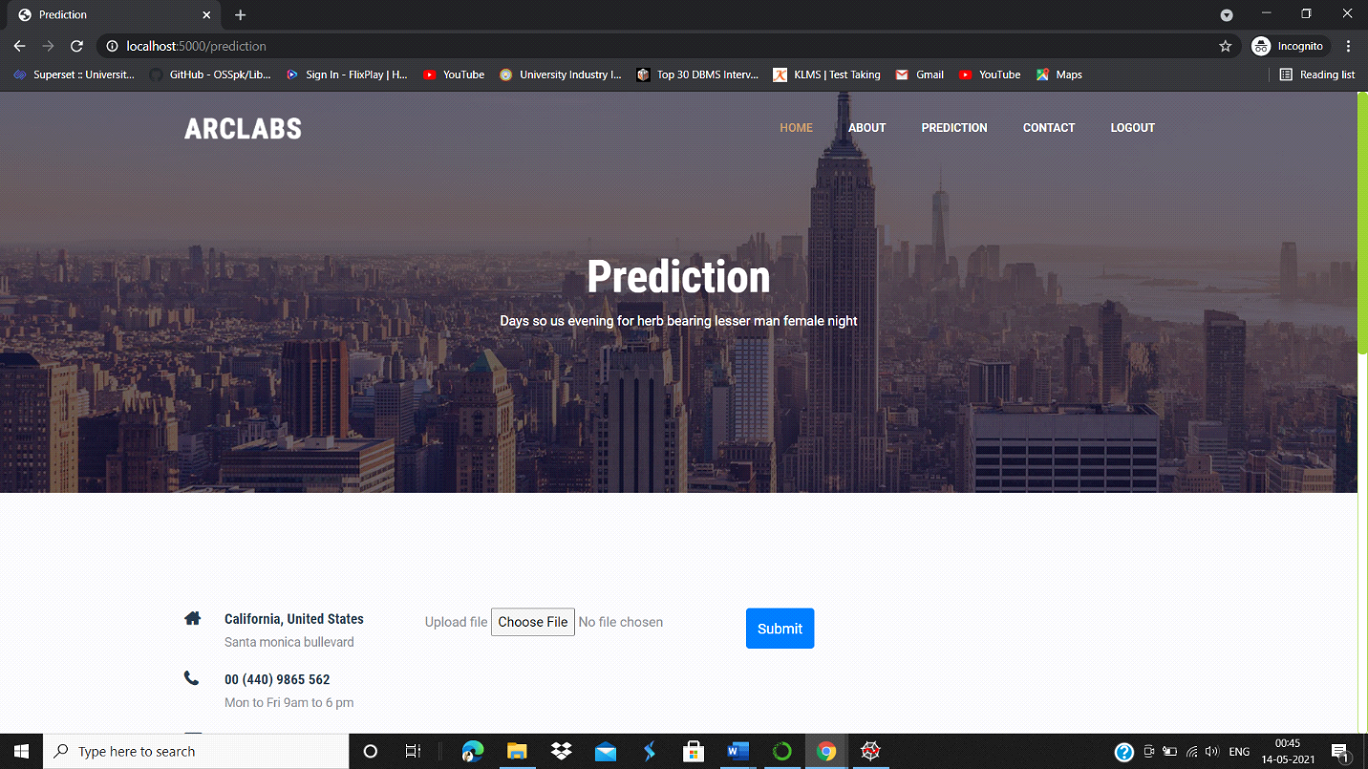

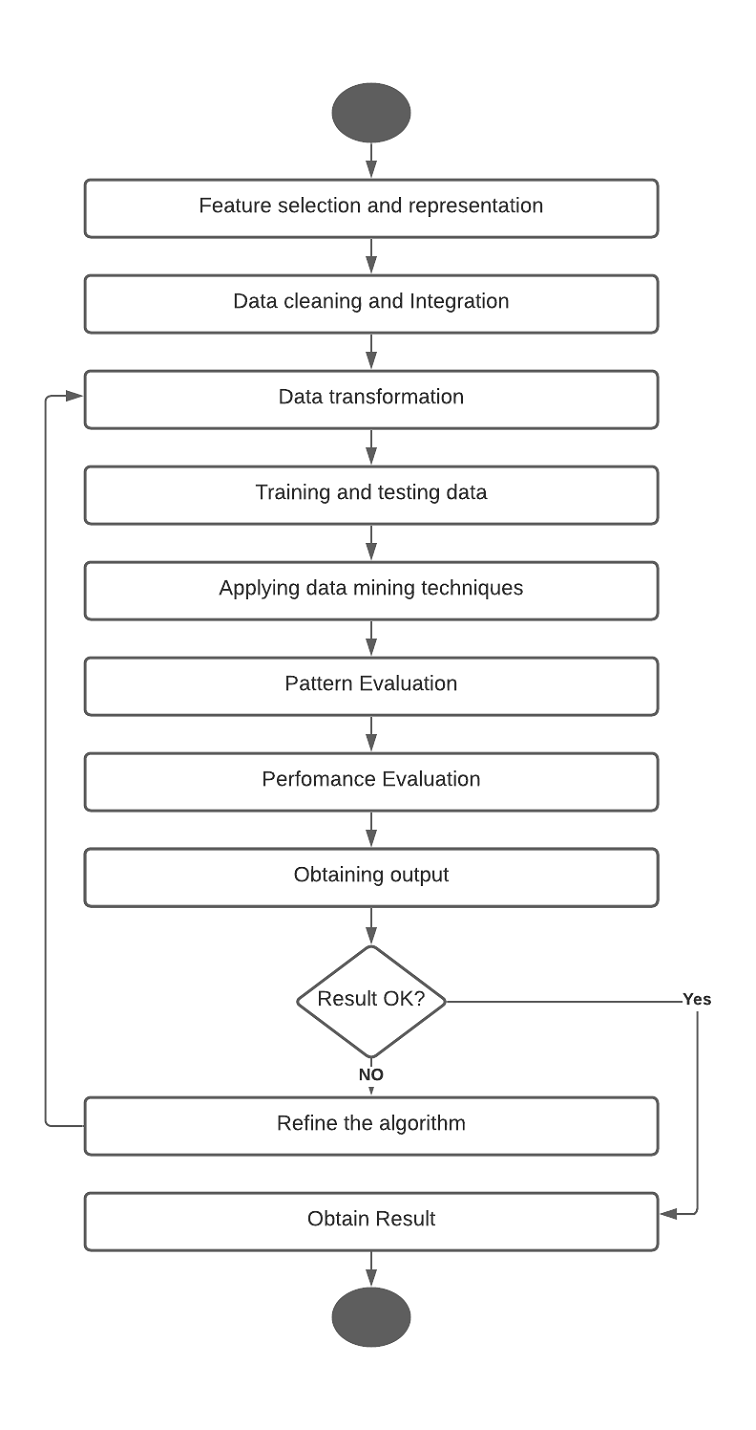

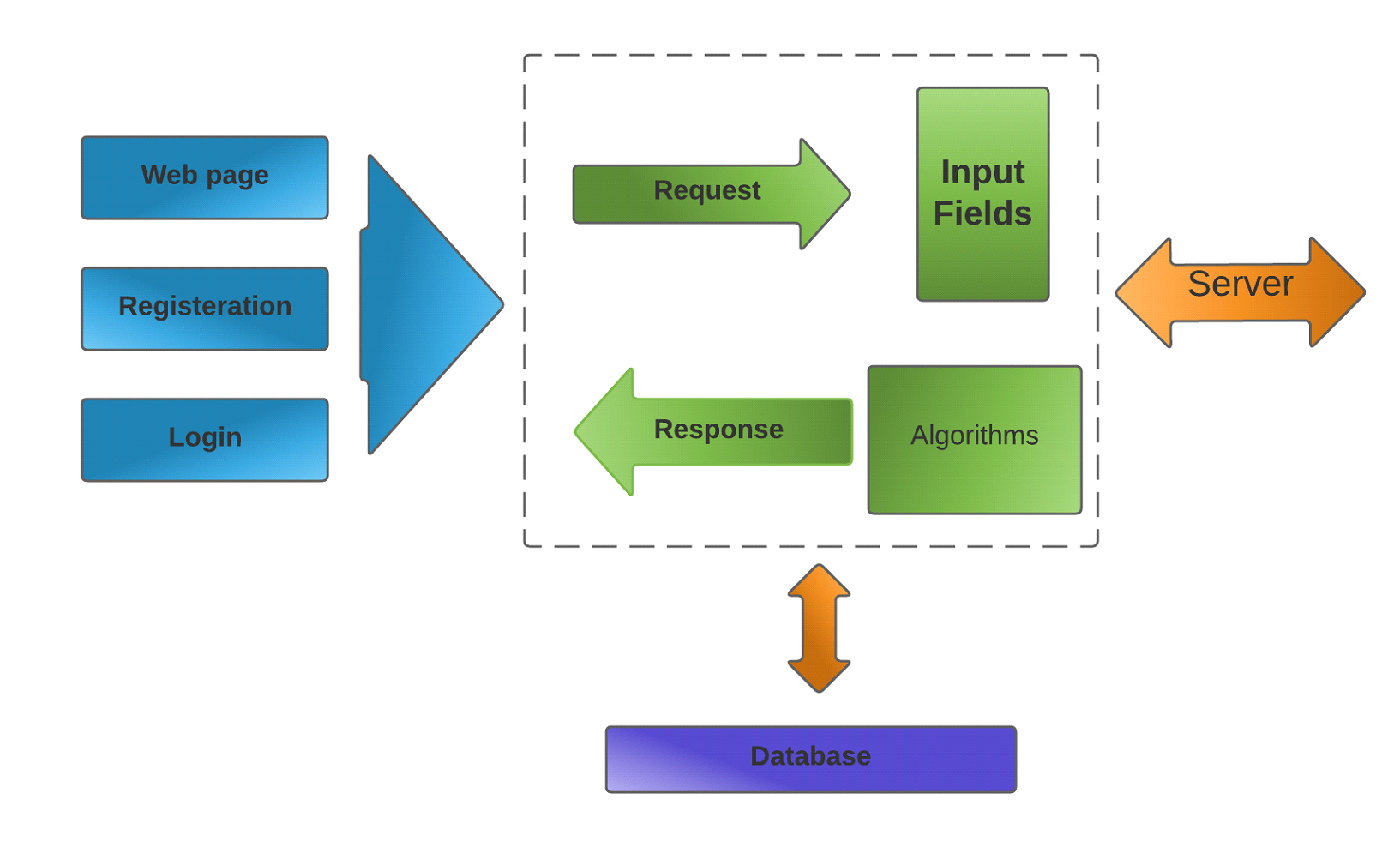

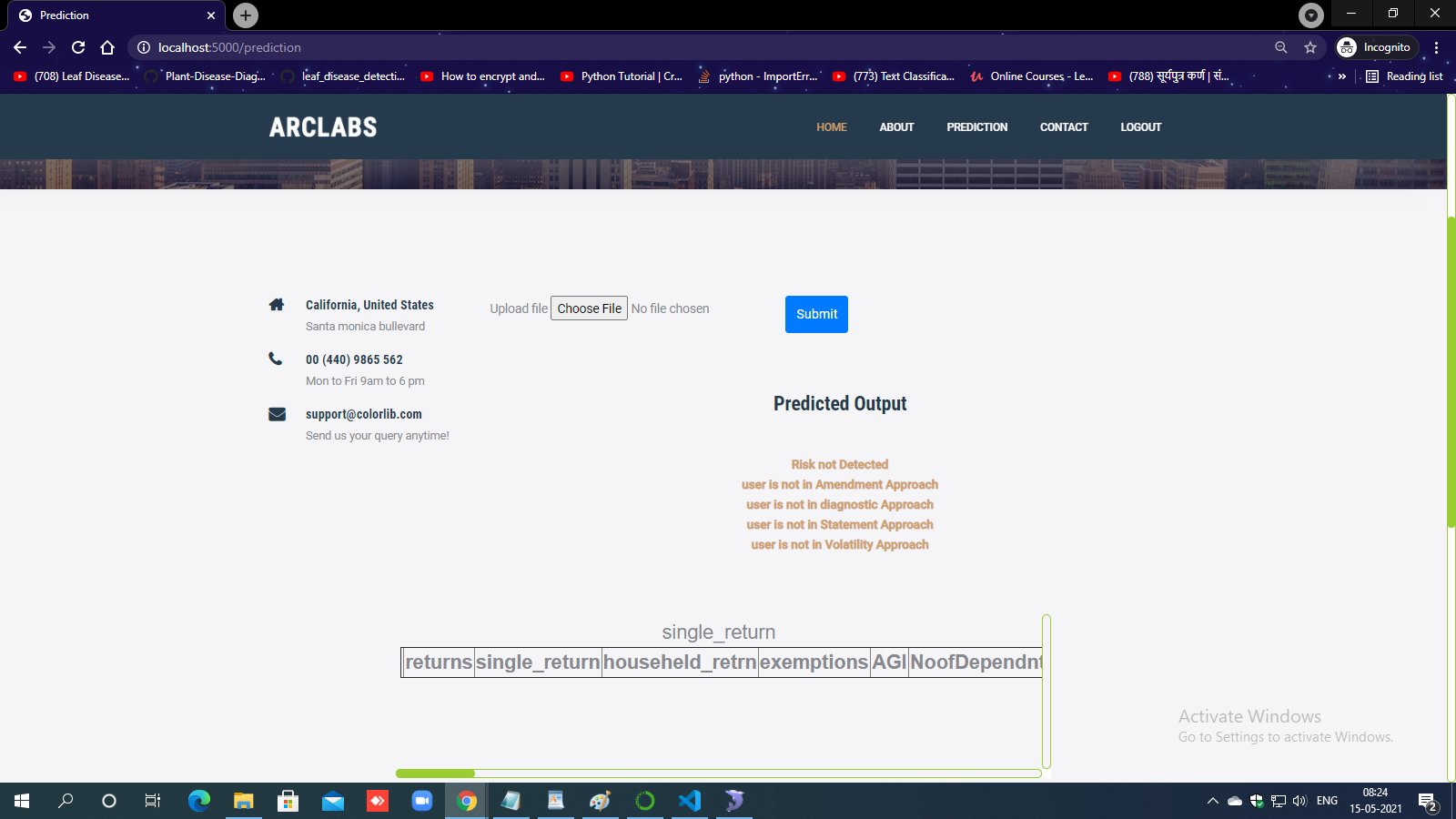

Machine LearningHigh-Risk Taxpayer Detection Using Machine Learning is a data-driven approach aimed at identifying taxpayers who are more likely to be involved in tax evasion or non-compliance. Traditional tax audit and risk assessment methods rely heavily on manual rules and random selection, which are often inefficient, time-consuming, and unable to scale with large volumes of tax data. This project proposes a machine learning–based system to improve accuracy and efficiency in detecting high-risk taxpayers. The system analyzes historical tax records, income details, filing patterns, transaction history, and compliance behavior to extract meaningful features. Machine learning algorithms such as Logistic Regression, Decision Trees, Random Forest, or Gradient Boosting are trained to classify taxpayers into high-risk and low-risk categories. The model learns complex patterns and anomalies that may indicate fraudulent or suspicious activities. Data preprocessing techniques including cleaning, normalization, and feature selection are applied to enhance model performance. The platform provides risk scores and classification results to assist tax authorities in prioritizing audits and investigations. Overall, this project enhances proactive tax compliance monitoring, reduces revenue loss, and supports informed decision-making through intelligent automation.

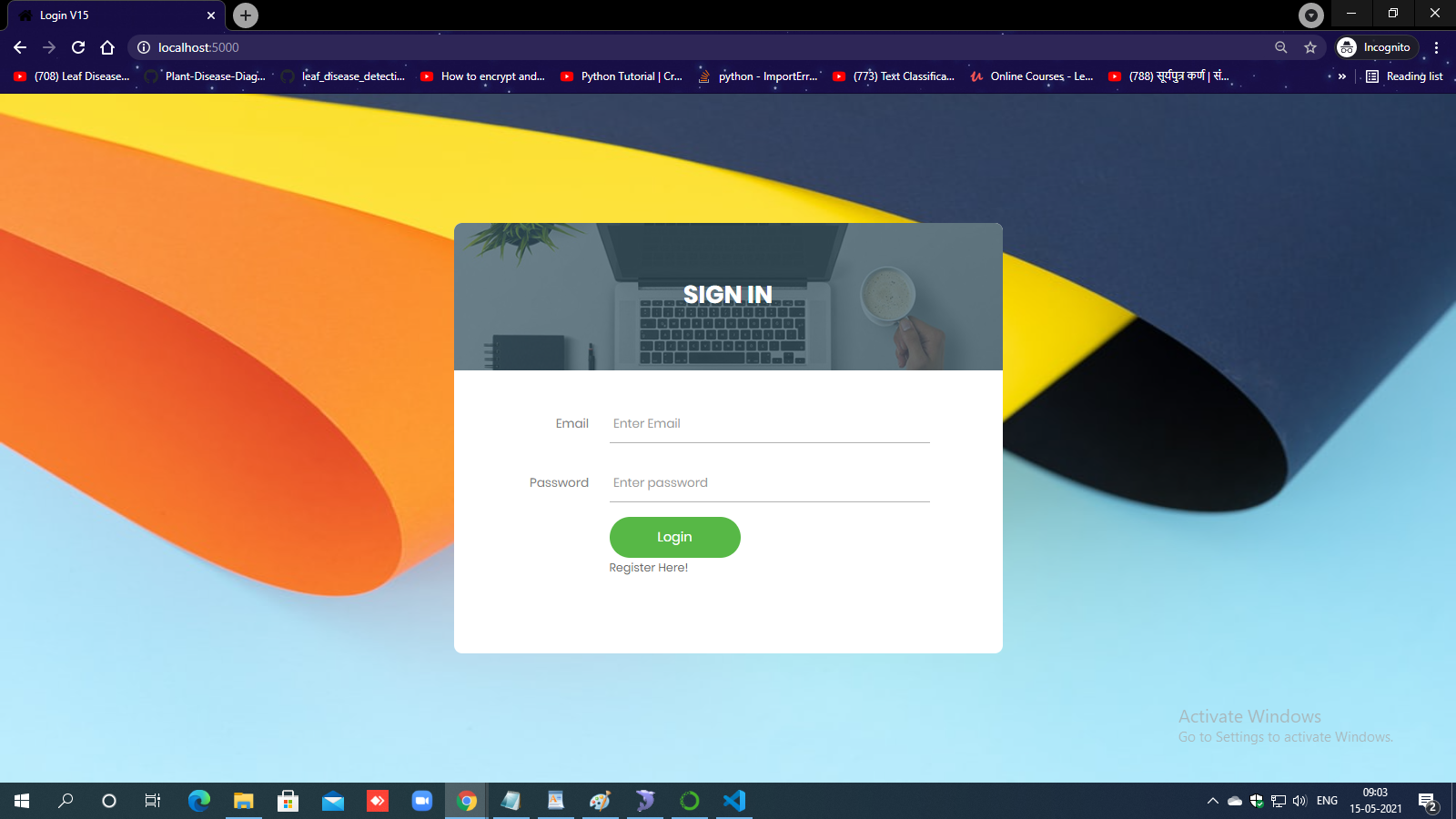

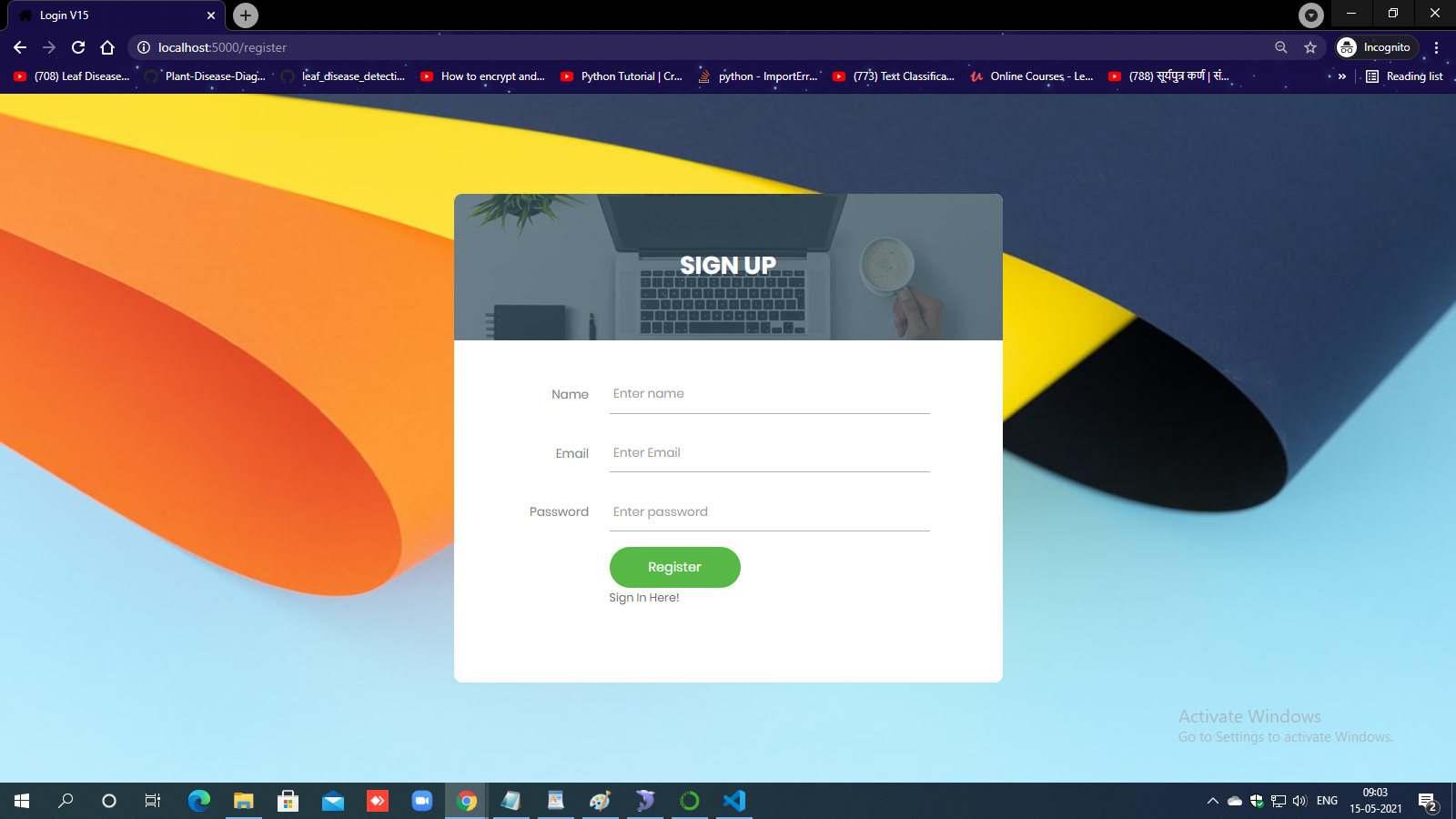

• Modern and responsive design

• Clean and maintainable code

• Full documentation included

• Ready to deploy